Post map

ToggleNowadays, social networks have become an important channel to reach customers in almost all industries that you can name, even in the banking and finance sector. The financial market has a great opportunity to take advantage of social networks to advise, educate and interact with customers. In this context, social media strategies help financial businesses build credibility and create long-term relationships. Social networks are no longer just a temporary trend, but a decisive channel to build trust for brands, including financial brands. But to operate communication activities effectively is a difficult problem. Follow this article of SOC LUA to explore the elements that make up a social media strategy for financial services.

The importance of social media in financial services

Social media has changed the way financial institutions connect with customers. According to Sprout Social, banks and investment funds use social media to build trust, provide knowledge and support to customers. Therefore, for the financial industry, having a clear social media strategy is essential.

For example, Buzzmetrics points out that 50% of consumers in key markets are now served by digital banks (up from 16% in 2018), which clearly shows the growing trend of digital services. Financial brands that have an active presence on social media will have an advantage in attracting new customer groups, especially the younger generation.

Another advantage of social media is that it is not only an advertising channel but also a customer care channel. Sotrender research shows that more than half (54%) of customers today prefer to contact their financial institution via social media messaging rather than email or phone. This statistic shows that if financial institutions only view social media as a one-way communication channel, they are missing out on effective customer care opportunities.

Choosing the right social media channels to start your social media strategy for financial services

There is no "the best" social media platform for every service. You need to consider your target audience and brand strategy to make a wise choice. Focus on one or two platforms that your target audience is likely to use.

For example, LinkedIn is a professional network with 950 million users and is considered a trusted place to share financial information. Statistics show that LinkedIn users are twice as likely to seek financial advice than other platforms, and the conversion rate is also twice as high. Therefore, if the goal is to reach business or professional clients, financial companies should invest in professional content on LinkedIn.

In addition, Facebook is still an indispensable channel with more than 3 billion global users. The ability to share diverse content (articles, images, short/long videos) and precise advertising tools (Meta Business Suite) help financial brands easily reach different customer groups. For example, American Express once reduced the cost of attracting new customers by 33% by running video ads on Facebook. In addition, another outstanding feature of Facebook is the ability to adjust messages to suit each group. With this feature, entertaining informational content can attract young customers while direct posts will be effective with middle-aged customers.

And of course, the list of top social networks cannot be complete without mentioning TikTok and short video platforms. TikTok has become the fastest growing social network with over 1 billion users, mainly Gen Z and Millennials. Short, fun and easily accessible videos on TikTok are an opportunity for financial companies to popularize financial knowledge in a vivid way. In fact, according to Tuoi Tre newspaper, in Vietnam, "62% of Generation Z consider TikTok a valuable source of financial knowledge", showing the huge potential of this channel. You can cooperate with influencers in the financial industry to spread the message and in fact, the investment in influencer marketing in the financial industry is estimated to increase 7 times the average ROI.

Create Engaging Content

Content is the key element of a social media strategy. To communicate effectively, organizations need to create content that is both engaging and culturally appropriate.

You can use social media to educate your followers on financial matters by sharing easy-to-understand advice on budgeting, saving, spending,... Simple tutorials on personal finance management, saving tips, or information on financial products and services must be presented vividly to impress users. This content not only helps build trust (tell the truth, explain clearly) but also brings practical value to customers, making them more attached to the brand.

Additionally, customer-generated content is also a useful way to exploit. For example, when customers are satisfied with the product/service experience, they can be encouraged to share success stories such as “how much money they saved thanks to product/service X”. You can then repost (with the customer’s permission) the post to show your appreciation for their opinions. This approach both builds trust and spreads information about the service in an authentic way.

Customer care

A big difference when building a social media presence is the ability to engage in two-way communication. Businesses often fail not because of posting and creating content, but because of not paying enough attention to users. If you don’t engage with users, they will likely lose interest and leave.

So, when someone comments or asks a question, you need to respond promptly with useful answers. The optimal solution is to direct customers to the appropriate department, who is ready to answer questions in a friendly and professional manner. An IAB study shows that 90% of consumers are likely to buy a brand’s products after receiving positive interactions on social media. This proves that responding to customers is not only about service, but also about increasing revenue and loyalty.

Measure effectiveness and optimize campaigns

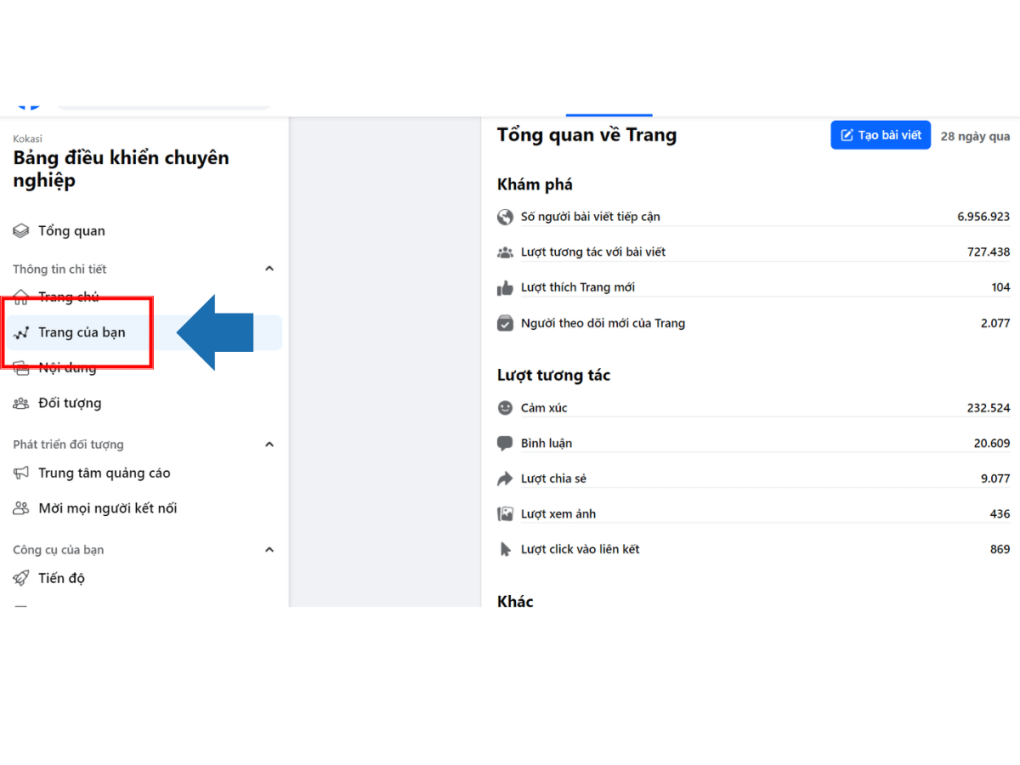

Of course, if you expect results from your communication activities, the process of building and operating the campaign must be done systematically. To evaluate the success of a social media strategy, KPI indicators must be clearly established. Important KPIs include the number of interactions (likes, comments, shares), website traffic and especially the conversion rate from advertising campaigns and service registrations, customer acquisition costs (CPA) and return on investment (ROI) of advertising on each channel also need to be monitored. The analytics tools of each platform (Facebook Insights, LinkedIn Analytics, TikTok Analytics) are important companions to measure the above indicators.

Also, don’t forget to measure the effectiveness with specific business results. If your goal is to invite, introduce new services or convert potential customers, check how many people sign up via social media links, how many people leave their contact information or use promotional codes from the campaign. These figures help calculate the true ROI of the strategy. For example, if an advertising campaign is aimed at unsecured loans for home/real estate purchases, you can compare the advertising costs with the number of loan applications approved from social media sources. This will help you know which channels and content are most effective to continue to promote, as well as which channels should be adjusted or discontinued.

Frequently Asked Questions

Content should be geared towards providing value and creating a connection with customers. Experts recommend focusing on educational content – for example, articles, short videos explaining basic financial knowledge, budget management tips or easy-to-understand market analysis. Most importantly, the content should be authentic, useful and appropriate to the style of each channel (for example, short videos on TikTok/Instagram or professional content on LinkedIn.

First are engagement metrics such as likes, comments, shares, and increased followers. Then there is traffic to your website or subscription channel. And most importantly, the conversion rate from the campaign. BlackRock says that LinkedIn can double the conversion rate of other social networks, so this can be used to evaluate the effectiveness of content and advertising on each channel. In addition, it is necessary to track the cost of customer acquisition (CPA) and return on investment (ROI) of advertising campaigns. In general, a good strategy is to continuously analyze data, identify the channels and types of content that bring results, thereby optimizing budgets and methods to make the campaign more effective.