Post map

ToggleRunning Facebook Ads is an indispensable part of every business's marketing strategy, helping to easily reach target customers and boost sales. To run ads on Facebook, you need to connect to a valid payment method to pay for advertising costs. Among the payment methods, Visa is the top and most popular choice for many businesses because of its convenience. However, to run Facebook ads, which visa card is best to use with high stability, efficiency and cost savings today, please refer to the following article of Soc Lua Agency!

What is a Visa card for Facebook advertising?

Is an international payment card issued by Visa in conjunction with a domestic bank. It is used for transactions, payments, or direct purchases at Visa card acceptance points worldwide. In particular, this type of card is used to pay for advertising campaigns on Facebook.

When running Facebook ads, you will need to link your Facebook Ads account to a payment method. Using a Visa card will help you pay advertising costs on Facebook quickly and conveniently, helping campaigns to be maintained and operated smoothly while helping to monitor and control costs more effectively. Make online payment transactions with just a few simple steps.

What types of Visa cards can be used to run Facebook ads?

To answer the question: "Which Visa card is best for running Facebook ads?", let's learn about the supported Visa cards. Currently, Facebook accepts payment through 3 types of Visa cards: Visa Debit, Visa Credit and Visa Prepaid. Each type of Visa card will have its advantages and meet the different needs of users:

Visa Debit Card

Also known as an international debit card, it is a payment card issued by Visa and linked directly to the cardholder's payment account. Visa Debit is widely issued by most banks in Vietnam such as Vietcombank, BIDV, or Techcombank, ... If you want to make transactions such as withdrawing money, or shopping online with this card, you need to deposit money into the account. The advantage of this type of card is that the card-making process is quick and easy, and the cost of opening and maintaining the card is low. The account balance is updated immediately after depositing money. High safety when used because spending is within the available balance limit on the card.

Visa Credit Card

This is a credit card, the top choice for those who regularly run Facebook ads with a large budget or need to maintain a long-term campaign. This type of card allows the owner to spend first and pay later. The user will be given a credit limit by the bank to spend and need to pay the amount used before the specified deadline. When registering for this type of card, you need to prove your income and ability to repay the debt.

Although it provides flexible spending with many attractive incentives such as cashback or bonus points, reduced transaction costs, etc., some banks such as VPBank, and Sacombank, etc. provide specialized credit cards for businesses with high financial support and security policies. However, the cost of opening and maintaining this type of card is higher than that of Debit. There is a risk of being blocked by Facebook because many people use credit cards to run ads without paying.

Visa Prepaid Card

Is a prepaid Visa card, a type of prepaid card for spending similar to a Visa Debit card, but it is not linked to a bank account. This type of card is quite popular abroad, but in Vietnam, there are not many banks that support this card. The outstanding advantage of this type of card is that it helps users control costs effectively and is safe to use because it reduces the risk of losing money. However, deposit and withdrawal fees are often higher than Visa Debit cards.

Which visa card is best for running Facebook ads?

To ensure the payment process and effective cost management when running ads on Facebook, choosing the right type of Visa card is very important.

Criteria for choosing the right Visa card to run Facebook ads

To choose the right type of Visa card when running Facebook Ads, you need to base it on the following criteria:

Security and safety

When choosing a Visa card to run Facebook ads, safety and security factors need to be the top priority. Because this type of card is used for online transactions, it needs to be equipped with modern security technologies such as OTP (One-Time Password) or 3D Secure to ensure that each transaction is authenticated in two steps. This is to minimize risks and prevent fraudulent acts. In addition, you should choose a card issued by a reputable bank with a good history of support for peace of mind when using it.

Appropriate credit limit

Directly affects the ability to pay for advertising campaigns. Cards with high credit limits are suitable for advertisers who need to run Facebook Ads with large budgets. Advertisers must check and ensure that the card limit meets Facebook's minimum payment requirements to avoid interruptions due to failed payments.

Low transaction fees

You should consider fees such as issuance fees, annual fees, and especially international transaction fees applied when paying in USD on Facebook. Some budgets have a policy of refunding international transaction fees or waiving annual fees in the first year, which will help you save significantly on costs. When you understand these fees, you can choose the most suitable card type.

Bank support

Visa cards allow for fast, easy, and secure online payments while saving time. When choosing a Visa card, you should choose to issue cards at banks with professional customer service. 24/7 support will help you quickly handle problems such as locked cards, declined transactions, etc. Some banks have digital banking applications that provide online card locking and unlocking features to manage transactions and track spending, bringing convenience to users.

What is the most popular Visa card type when running Facebook ads?

Which Visa card is suitable for running Facebook ads? With its convenience, easy and quick issuance and effective spending control, Visa Debit cards are the top choice of many businesses. Because it can be linked directly to a personal bank account. Allowing users to spend first and pay later is very suitable for businesses that need to run large-budget ads.

You can deposit money into your account before running a campaign and the amount will be gradually deducted through linking the Visa Debit card number. This helps you easily control the amount spent and avoid exceeding the set budget. This is the reason why many advertisers prioritize using Visa Debit cards to run and optimize Facebook Ads campaigns.

In addition to choosing the right type of Visa card, you also need to choose a card-issuing bank to help make transactions quick, simple and cost-effective. Some reputable banks that many businesses choose you can refer to are:

- Vietcombank

- ACB (Asia Commercial Bank)

- Techcombank

- Sacombank

- BIDV

- MB Bank

- HSBC International Bank

- VIB Bank

- TPBank

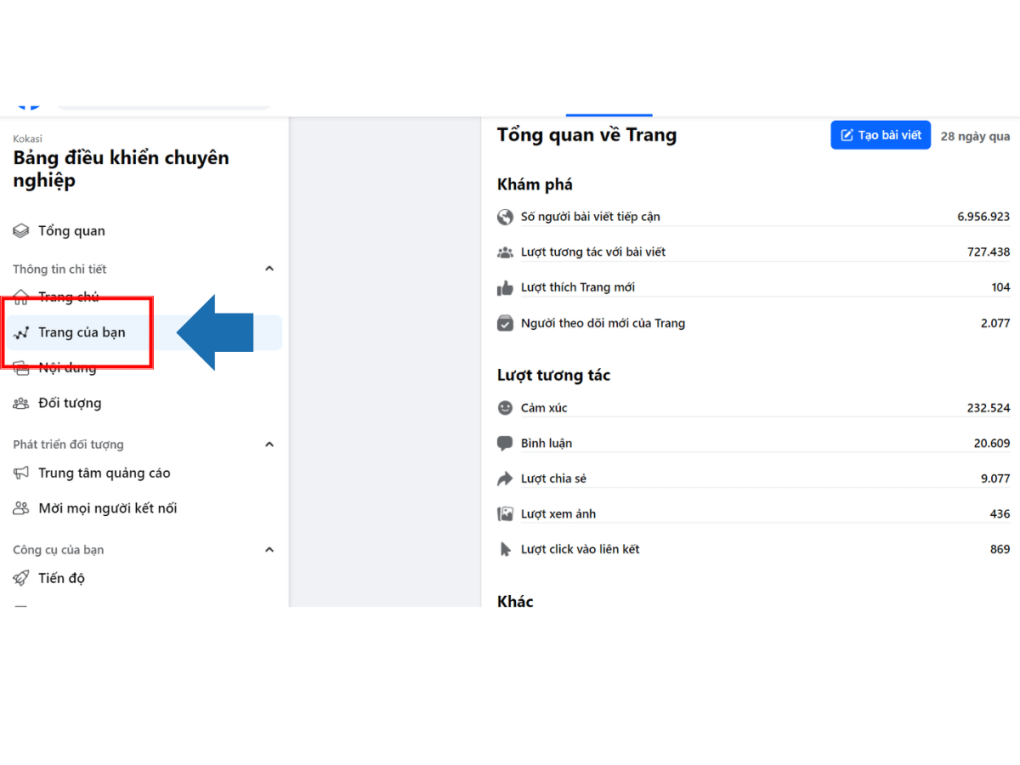

How to add a Visa card to a Facebook advertising account

After you have made your choice: "Which Visa card should I use to run Facebook ads?", follow these steps to add the card to your account:

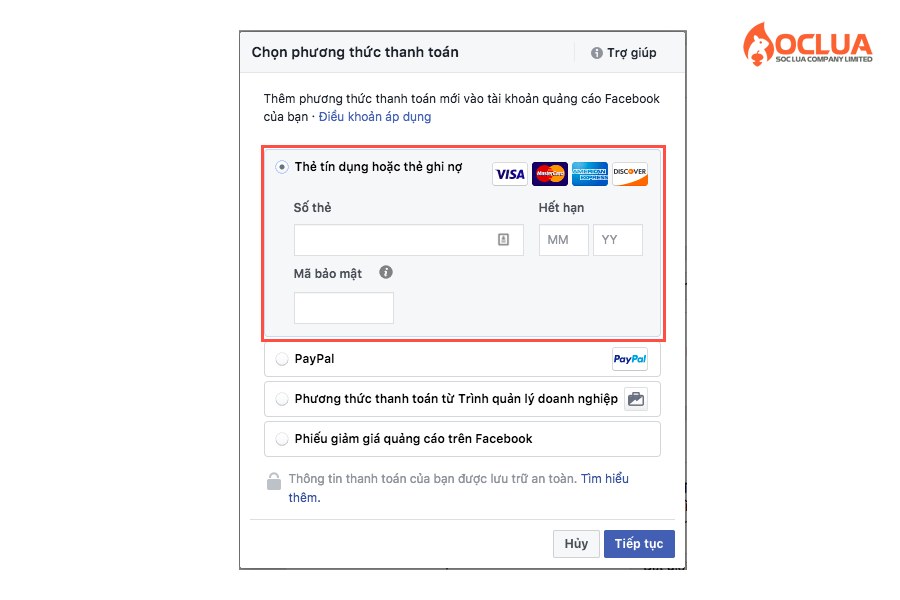

Access Ads Manager and select Business Settings. Then select Payment Methods and select Add Payment Method. Next, select the Visa card and enter all the payment information including the card number, card expiration date and the CVV security code which is the 3 digits on the back of the card. Finally, click Save to save the information.

If you want to add a card to your personal Facebook account, go to Settings and select Payment. Next, select Account Settings and select Payment Methods. Then, select the Visa card payment method and enter the information including card number, expiration date, security code and country.

Once you have successfully added the Visa card to your account, you should wait about 2-3 days for the account to stabilize before running ads. Because the account is still quite new, the reliability is not high, so you should only run campaigns with a low budget first and then gradually increase it.

In case you want to remove the Visa card from your Facebook advertising account, after selecting Payment Methods in the Business Settings section in Ads Manager, find the Visa card you want to remove. Here, click on the 3-dot icon next to the Visa card and select Remove. Then confirm the card removal by clicking Remove and you're done.

However, you can only remove the Visa card after completing the payments for the advertising campaign. Before removing the card, you need to pause or end the running advertising campaign.

Now, you have the answer to the question: "Which Visa card is best for running Facebook ads?". Visa Debit cards are often preferred by businesses because of their flexibility and good spending control. Make this card at a reputable bank to run Facebook ads effectively, safely and at the most optimal cost!

Frequently Asked Questions

According to Facebook's instructions, each Visa card can add up to 10 Facebook advertising accounts. This is to help Facebook better control payment transactions and minimize the risk of fraud. Some advertisers say that Visa cards can only be added to a maximum of 3 advertising accounts. If possible, it is best to only run each card for 1 account. Besides Visa cards, you can use other payment methods supported by Facebook such as PayPal, domestic debit cards, etc.

The time to make a Visa card to run Facebook ads will vary depending on the type of card. Debit cards are usually issued quickly, taking only a few days. Credit cards can take up to 1-2 weeks or longer. In addition, depending on each bank, there will be different procedures and processing times for card issuance applications. Usually, the time to make a Visa Debit or Prepaid card to run Facebook ads will be quite fast, from 3 to 5 days. Meanwhile, a Credit card will take longer due to the need to evaluate the application.